Why it’s important to monitor travel index reports

Keeping track of the travel index for the main destinations where employees go on business trips is especially important in order to properly shape a company’s travel policy. After all, timely updates of limits and calculations for future periods are the key to success. If you need the expertise of Roundtrip specialists, or any analytics or advice on how to come up with an effective travel policy, you can contact your account manager.

Zurich, London, Tokyo, Geneva, and Paris occupy BTN’s top spots for non-US cities. In these cities, business trips will cost the most, and per diem costs will be $500-600. These cities are also ranked as “very safe” in terms of risk level (risk index in the report is a composite factor that takes into account crime, healthcare and incidence of coronavirus cases).

Among U.S. cities, business travelers see New York as the most expensive city to visit. One day of a business trip will cost an average of $540, and the risk index is rated as “very safe”. The top five also included Santa Barbara, San Francisco, and Los Angeles, as well as Phoenix, Arizona. Average per diem rates in these cities are in the $400-500 range.

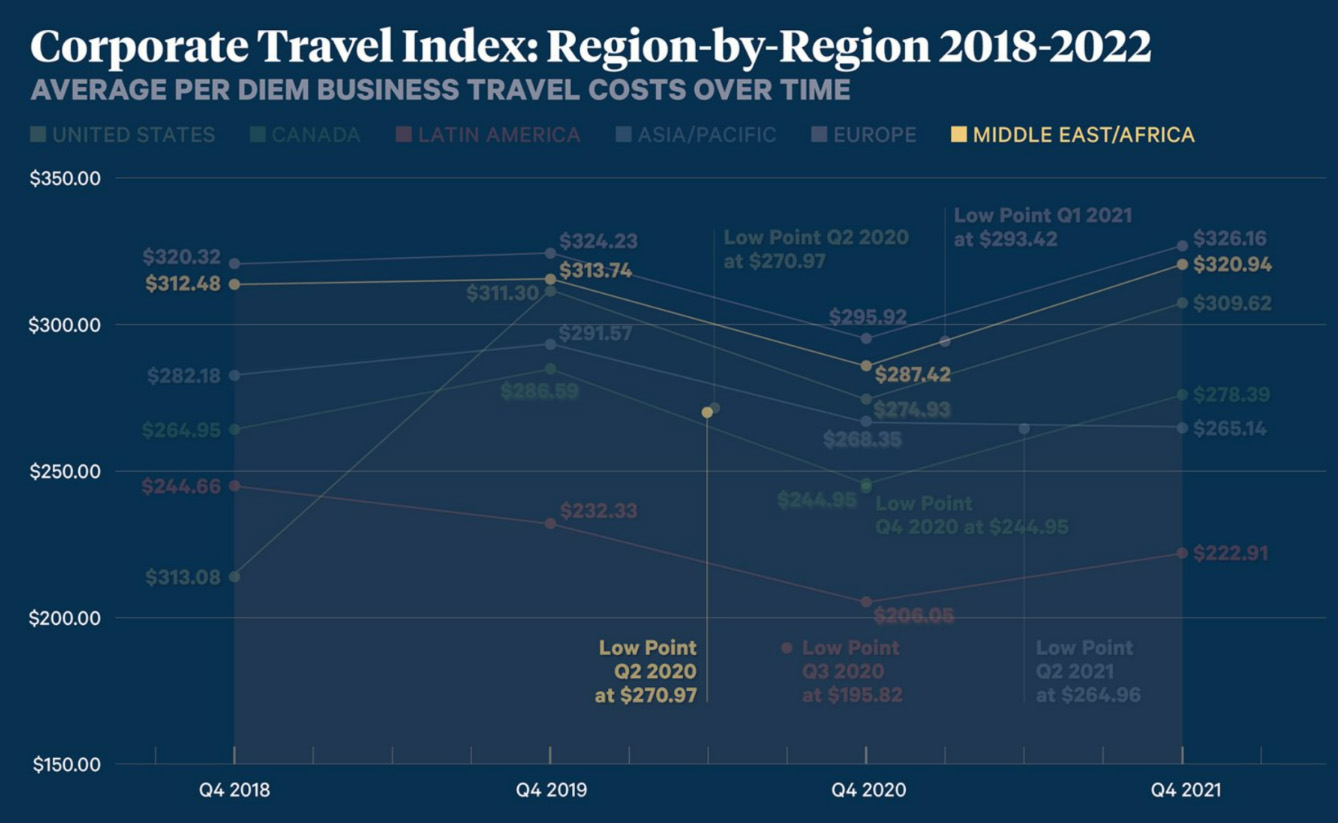

Overall, the report reveals that the average per diem costs of business travel will continue to rise in each of the regions surveyed. According to BTN’s forecast, business-travel spending is going beyond the usual trend and will be more dependent on environmental, economic, social and geopolitical factors.

Overall, the report reveals that the average per diem costs of business travel will continue to rise. Screenshot: BTN

The recovery of business travels and offline meetings is happening faster than had expected

As prices rise, many companies and travel managers will also face the effects of pent-up demand for business travel. Despite earlier forecasts that business travel would be the last in line for a recovery, we see a slightly different picture today. Employees who went on regular business trips before the pandemic struck are gradually resuming their usual business lifestyle. They are now eager to return to in-person meetings with clients and colleagues as soon as possible.

At a time when hybrid and remote meetings have become commonplace, companies and organizations are trying to quickly restore the previous level of working relationships, teamwork and corporate culture, as well as increase the level of trust between colleagues. The first half of the year already witnessed a surge in face-to-face meetings between company employees.

According to a survey of remote workers by Oxford Economics, 38% of respondents said that employers were now more often encouraging face-to-face meetings. Also, 32% responded that their employer would like corporate training to be held offline, 29% received incentives for attending holiday parties in the company, and 20% for having a face-to-face meeting with their supervisor.

The recovery of business travels and offline meetings is happening faster than had expected. Photo: Briana Tozour / Unsplash

Travel managers are seeing a recovery in business tourism and are trying to adapt to new trends by adopting various strategies that would help reach a compromise between increased demand for offline meetings and budget constraints. These strategies may include various mechanisms that enable companies to be prepared for unscheduled cancellations, rescheduling of business trips, and refunding of unused flight tickets.

As part of budgetary control, managers are encouraged to find a balance between two metrics – number of trips planned and cost of each business trip. For example, you can reduce the total number of business trips while doubling the cost per trip. Or you can find the right combination of these two metrics to stay within the company’s budget. Real-time price monitoring or analysis of collected data on previous trips can also help avoid overspending. Some managers may also employ corporate traveler incentive tactics. The method aims to encourage employees to save more corporate funds on business trips. This approach would reduce the company’s overall cost, but not severely cut back on sending employees on business trips.

Expense report as an effective tool for cost estimation

Expense report helps you to effectively manage and control all your travel expenses using filters and then examine the analysis. It’s already available on Roundtrip. Go to Reporting → Online Account → Expense report.

Advantages of the expense report

- All services that were ordered (for example, hotels, flights, and transfers) are uploaded into one file, but in different tabs, so they don’t get mixed up.

- A convenient filter that enables you to assess your expenses for a specific day, week, or month.

- A tab with analysis showing the total amount of expenses and also a breakdown of expenses for each service.

- A booking window data makes it possible to check how many days before the business trip the hotel or other services were paid for.

This way, you’ll be able to identify patterns, adjust or update your travel policy and manage your budget more effectively.

The report emphasizes that the global situation is changing so rapidly that it has become extremely difficult to predict changes even in the short term. For example, South Africa was one of the first countries to experience an outbreak of COVID-19 omicron variant, but soon became the first country in the region to lift most restrictions on international travelers.

Using the calculator developed by BTN, you can research the travel index of various cities on your own. Screenshot: BTN Сorporate Travel Index Calculator

Europe and North America

Coronavirus outbreaks remain a key factor affecting business travel recovery this year. New hotbeds of the virus have been regularly reported in Europe, which was the pre-pandemic leading destination for business travelers. However, it is not yet clear how the new waves of the disease in Europe would affect the structure and volume of business travel. Since pandemic fatigue is seeping in across Europe, a lockdown is an unlikely option. European authorities are more likely to focus on vaccination and hospitalization rates rather than the number of new cases. So far, the UK, Germany, France and Italy have lifted most of their COVID-related entry restrictions.

The U.S. still requires proof of being fully vaccinated or a negative PCR test for all international travelers. At the local level, however, many restrictions have been lifted. For example, most states no longer require masks to be worn in public places.

Domestic business travel in the U.S. is also passing through difficult times. Despite expected business travel market recovery in 2022 and increased demand for air travel in the first two quarters, employers are cutting back on business travel spending. For example, U.S. companies cut their business travel budgets by 25% this July compared to the same month last year.

Domestic business travel in the U.S. is also passing through difficult times. Photo: ben o’bro / Unsplash

Asia-Pacific

The Asia-Pacific region is also easing pandemic-related travel restrictions. Australia, which, for nearly 100 weeks, had some of the strictest covid restrictions in the world, lifted most of these restrictions for international travelers in the first quarter of this year. New Zealand opened its borders to tourists in August and has now lifted all covid restrictions; vaccination certificates and PCR test results are no longer required for entry. South Korea lifted its quarantine requirements for incoming international tourists in March. Japan, which closed its borders to travelers during the new Omicron variant of COVID-19, is reopening to student and short-term business travel. As of October 11, the country is lifting almost all restrictions on arrivals. Thailand also stopped requiring PCR tests from all tourists starting on October 1.

Despite the general tone of positive news in the region, the risks of new waves of the coronavirus remain high. At the end of summer and early fall, many countries in the region experienced a sharp rise in the number of cases. For example, China, which continues to adhere to a “zero-tolerance” COVID-19 policy (even for isolated cases, Chinese authorities can impose a lockdown on entire counties and quickly carry out mass testing), had to send 37 million people to lockdown across the country, including Beijing, Shanghai and Shenzhen. South Korea also experienced another spike in infection rates in late summer.

South Korea lifted its quarantine requirements for incoming international tourists in March. Photo: Markus Winkler / Unsplash

Latin America

In Latin America, business travel market recovery is primarily driven by domestic travel. However, since Q2 2022, after yet another wave of cases had faded, international business travel within the region gradually began to return. The study predicts that this year will see a demand for international business travel within the region reaching 70% of pre-pandemic levels. The recovery trend of the business travel market is also influenced by international tourism. As the demand for air travel increases, so does the price of hotel services. Both factors will inevitably but positively affect the business travel industry.

In Latin America, business travel market recovery is primarily driven by domestic travel. Photo: Social Income / Unsplash

According to BTN analysts, demand for global business travel will continue to increase at least until the end of 2022. Meanwhile, the hotel industry’s recovery has acquired an atypical nature – room rates are the main driver of the recovery, rather than occupancy rates. In almost all regions of the world, room rates have reached pre-pandemic levels, and have even exceeded it in many cities in almost all regions of the world.